Policies such as fees services and amenities provided and expected conduct of occupants vary by entity.

Irs definition of college room and board.

If you are considering an off campus living arrangement and you can t find an estimate call the university and ask for information.

This information can usually be found under the college s financial aid tab.

If you are referring to a college savings plan such as a 529 plan then the answer is sort of.

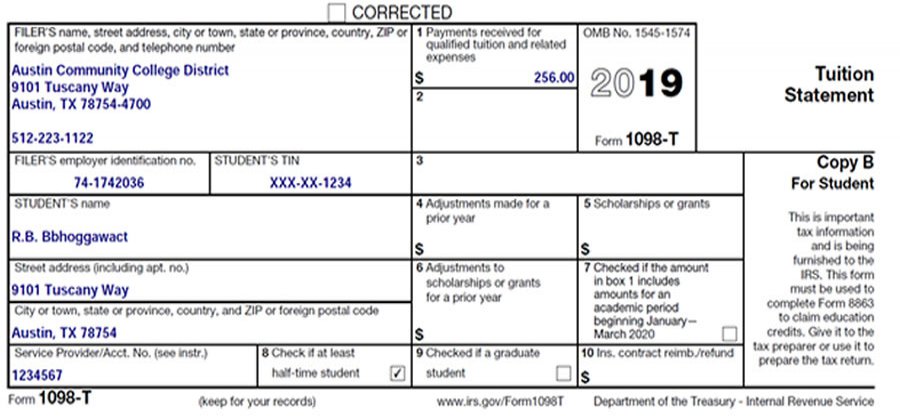

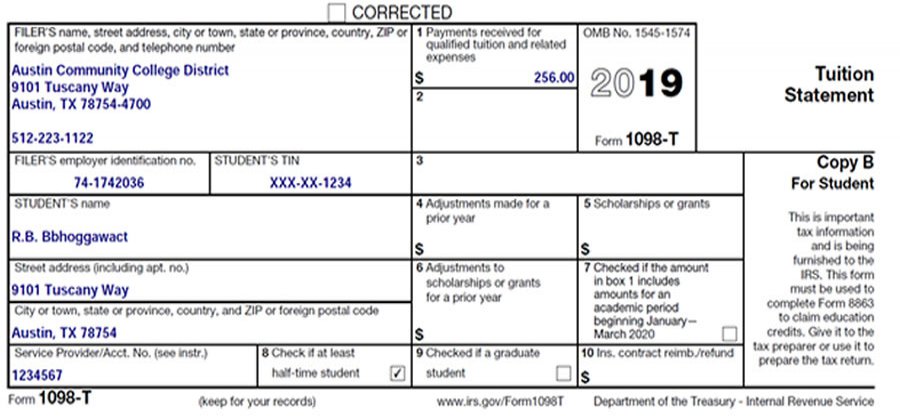

Qualified education expenses are amounts paid for tuition fees and other related expenses for an eligible student.

Estimating tuition room and board.

Yes that is counted as room and board but only up to the amount of amount of room and board the college would charge for on campus room and board.

Please note that in some situations room and board expenses are only includable if the student was enrolled at least half time.

Additionally you may need to check with the educational institution to determine the amount paid specifically for room and board.

Most college websites provide a breakdown of estimated expenses.

Please see irs publication 970 tax benefits for education for additional information.

You can claim an education credit for qualified education expenses paid by cash check credit or debit card or paid with money from a loan.

The internal revenue service has guidelines for determining when room and board is taxable income and when it s just a tax free perk.

Room and board refers to lodging utilities and food provided for a fee or in exchange for specified duties or services.

Room and board is provided by various entities such as colleges and private residences.